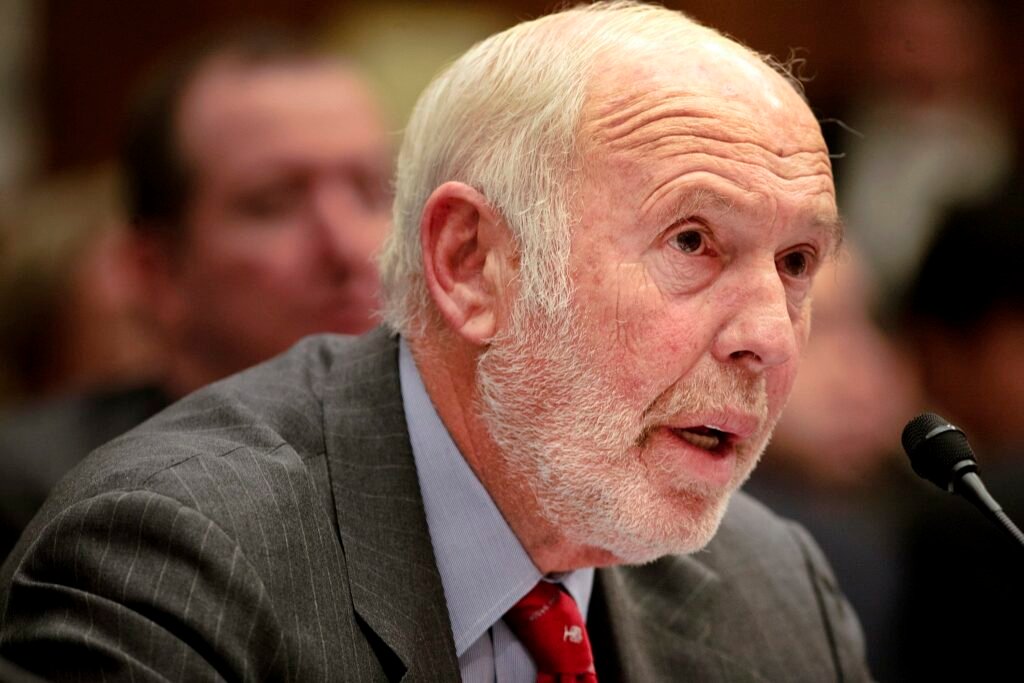

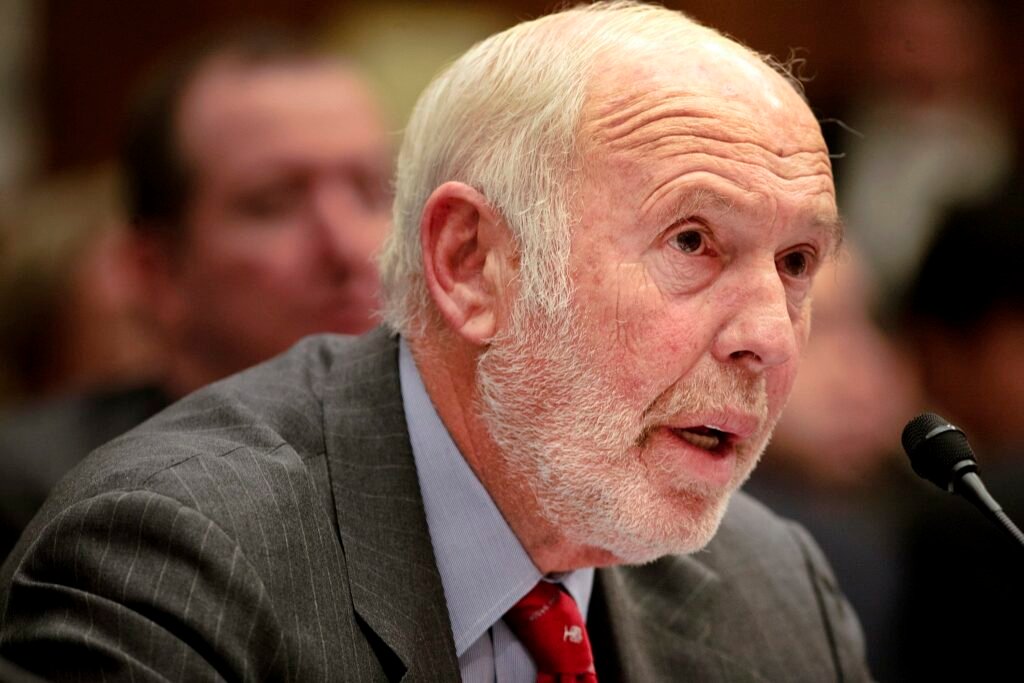

Jim Simons He is one of the mysterious figures on Wall Street. As the founder of Renaissance Technologies and creator of numerous quantitative trading strategies that consistently beat the markets, Simmons journey was a combination of academic brilliance mixed with an unconventional approach.

Table of Contents

Net Worth

In 2024, Jim Simons’ net worth is set to be $28 billion, according to Forbes. Most of this money he actually made through his hedge fund Renaissance Technologies, where their flagship Medallion Fund has been described as one of the most profitable trading operations in history; however, Simons could also make this fortune grow by reinvesting and diversifying it effectively.

Simons is also a well-known philanthropist and has given away billions of dollars to education, scientific research and medical causes via the charitable organization he founded with his wife called The Simons Foundation, which is now one of the world’s largest private charitable foundations.

Biography

Table of Glimpse: Jim Simons

| Aspect | Details |

|---|---|

| Full Name | James Harris Simons |

| Date of Birth | April 25, 1938 |

| Place of Birth | Brookline, Massachusetts, USA |

| Net Worth (2024) | $28 Billion (Forbes estimate) |

| Primary Source of Wealth | Renaissance Technologies (Quantitative Hedge Fund) |

| Known For | Founder of Renaissance Technologies; Quantitative Trading Strategies |

| Education | – Co-developed the Chern-Simons Form; – Medallion Fund’s 66% annualized returns (pre-fees) |

| Key Achievements | – Co-developed the Chern-Simons Form – Medallion Fund’s 66% annualized returns (pre-fees) |

| Company | Renaissance Technologies |

| Books About Him | “The Man Who Solved the Market” by Gregory Zuckerman |

| Philanthropy | Simons Foundation; Donations to education, science, and autism research |

| Retirement | Retired from Renaissance Technologies in 2009 but remains chairman |

April 25, 1938: James Harris Simons (Jim Simons) is born in Brookline, Massachusetts.Academics: He received a Bachelor of Science degree in mathematics from MIT and a Ph.D. in mathematics from the University of California, Berkeley, at age 23.

Government Service: Simons was invited to interview at IDA in cryptography. His language skills were so fantastic that his interviewer said, I thought he would be my dream client. But he wanted nothing to do with it and answered my questions in one syllable. Soon after, an interviewer called and made him a very interesting offer, which he mused about the implications for several weeks (more than). At some later date, someone provides process documentation on theory development.

Education

Education was a big feature of Jim Simon’s early life.

- Undergraduate Education: Massachusetts Institute of Technology (MIT), Mathematics.

- Doctorate: University of California, Berkeley, Ph.D. in Mathematics.

The mathematical rigor and problem solving he got from his academic journey were keys to opening the door to success in quantitative finance.

Stragey

- Quantitative Trading: Simons and his team at Renaissance Technologies use models to trade, i.e., they make buy/sell decisions based on their analysis of the terabytes of data they collect from the market.

- Data-Driven Decisions: Unlike normal hedge funds, who think that they are masters of the universe and trust their gut or intuition, Simons’ strategies are backed by statistical modeling as well as machine learning.

- High-frequency trading: The Medallion Fund is a computer-based, high-frequency trading fund. This means the fund is looking to make profits from the short-term market inefficiencies.

Company: Renaissance Technologies

Team of Scientists: Renaissance Technologies doesn’t employ Wall Street traders to develop and execute its trading strategies. It recruits scientists and mathematicians from fields other than finance. Who is Jim Simons? What is quantitative analysis? Their Medallion Fund, the firm’s flagship fund, has generated over 70% annually (before fees) since its inception in 1988. The firm uses computer-based models to predict changes in the prices of publicly traded financial instruments. If it wasn’t an outlier, nothing could be.

Founded in 1982, Renaissance Technologies is a quantitative hedge fund and the firm that has actually applied the scientific way of using technology to beat the markets. It uses systematic trading based on mathematical and statistical models scientifically developed and implemented through big data analysis and high-performance computing systems.

- Medallion Fund: Renaissance employees only fund; the returns of this fund are literally in a league of their own.

- Other Funds: Renaissance also manages institutional money, such as the Renaissance Institutional Equities Fund (RIEF) and Renaissance Institutional Diversified Alpha (RIDA); however, these funds have performed nowhere near as well as the Medallion Fund.

Books on Jim Simons

Culture: Renaissance has a unique work culture; it hires mostly PhDs in areas such as mathematics, computer science and physics. This ensures the investment approach is scientific and academic.

- “The Man Who Solved the Market” by Gregory Zuckerman. This is the most recent one, and it’s great. It goes through Simon’s biography from childhood to retiring as CEO of Renaissance Technologies and has tons of specifics about the firm.

- “More Money Than God” by Sebastian Mallaby. It’s actually not only about Jim Simons but also about other hedge fund legends such as George Soros.

- “Manifold: The Paradox of the World’s Greatest Mathematician” by John Mighton. This isn’t specifically about Jim Simons, but I figured a lot of you guys here would enjoy this book too, so I decided to include it anyway.

- The Man Who Solved the Market by Gregory Zuckerman is the best answer to your question. Biography on Jim Simons, his life, work and explanation of some of the investment strategies he implemented, which were truly groundbreaking.

FAQs

Is he still active with Renaissance Technologies?

Yes, he is! But officially, Jim Simons retired from his position as CEO in 2009. He still remains involved with the firm and heads up their board.