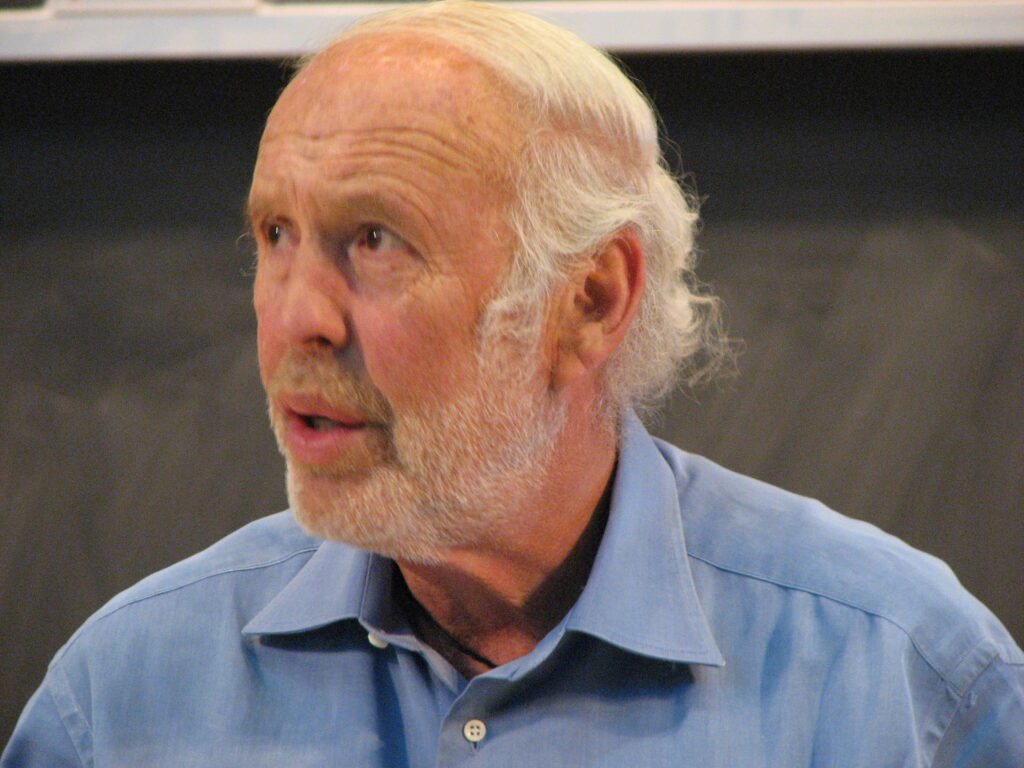

James Harris Simons, also known as Jim Simons, is an American mathematician, hedge fund manager, and philanthropist. He is known as a quantitative investor and, in 1982, founded Renaissance Technologies, a private hedge fund investment company based in New York City. Simons’ net worth is estimated to be $23.5 billion.

Table of Contents

Net Worth James Simons

As of 2024, Jim Simons’ net worth is reported to be $28 billion, making him one of the world’s richest hedge fund managers. The majority of his wealth comes from Renaissance Technologies, whose flagship Medallion Fund has achieved unparalleled success and thus earned enormous profits for its staff and investors.

Biography James Simons

Table of Glimpse: James Simons

| Aspect | Details |

|---|---|

| Full Name | James Harris Simons |

| Date of Birth | April 25, 1938 |

| Place of Birth | Brookline, Massachusetts, USA |

| Net Worth (2024) | $28 Billion (Forbes estimate) |

| Primary Source of Wealth | Renaissance Technologies (Hedge Fund) |

| Education | “The Man Who Solved the Market” by Gregory Zuckerman |

| Career Highlights | “The Man Who Solved the Market” by Gregory Zuckerman |

| Books About Him | – “The Man Who Solved the Market” by Gregory Zuckerman |

| Strategy | Quantitative Trading using mathematical models, machine learning, and data-driven decisions |

| Fund Performance | Medallion Fund: Over 66% annualized returns (pre-fees) |

| Yacht | “Archimedes” (223 feet, built by Feadship) |

| Notable Properties | East Setauket estate in Long Island, New York, and other luxury properties |

| Age | 85 years old (as of 2024) |

| Height | 5 feet 10 inches (178 cm) |

| Wife | Marilyn Hawrys Simons (Philanthropist, Co-chair of Simons Foundation) |

| Philanthropy | Simons Foundation: Focused on mathematics, autism research, and education |

Craig holds a Master of Science degree in Computer Science and a Bachelor of Science in Electrical Engineering and Computer Science from the University of California, Berkeley.

You can call him Jim Simons. It’s short and to the point. Ta-daa, you have it.

Place of Birth: Brookline, Massachusetts, USA

Education:

- Undergraduate: Bachelor of Science in Mathematics, MIT

- Doctorate: Ph.D. in Mathematics, University of California, Berkeley

Career Path of James Simons

After working as a cryptanalyst at the National Security Agency (NSA), he decided to work in academia and taught mathematics at MIT and Harvard University. Simons’ most notable work involved the discovery and application of certain geometric measurements, called now the Chern-Simons forms, which are used in modern theoretical physics.

- In 1982, Renaissance Technologies was created by James Simons.

- I don’t know why such a successful personality like Jim Simons has so few books written about him. I guess it is possible that maybe he avoids speaking to the press and declines book offers.

But in my opinion, if someone wanted to write a book on one of the most private yet influential figures out there, then writing a well-researched piece on Jim Simons would be an absolute blockbuster.

Books About Jim Simons

On the contrary, there are other books on Renaissance Technologies, the firm with its internal code name Monemetrics opened by Jim Simons 4 decades ago that rose to become possibly those markets best performing hedge fund ever.

A number of books have been written about Jim Simons and his groundbreaking work. The most notable is:

“The Man Who Solved the Market” by Gregory Zuckerman

The biography details Simons’ early influences and how he became a codebreaker for the U.S. Department of Defense during the Vietnam War. The Overview also looks at Simons’ pioneering theories in mathematics, which led him to develop quant-driven James Simons trading strategies and new financial instruments that Simons used to transform bond trading in the late 1970s.

Throughout Simon’s career, outsiders were never fully certain how exactly he was able to achieve such astounding returns with his Medallion Fund, but Zuckerman’s biography does shed some light on how Renaissance Technologies operated over the years.

- How Simons harnessed mathematics and data to reinvent investing.

- The many obstacles he had to solve to build and hold onto Medallion’s edge.

The investment approach at Renaissance was designed to be robust to myriad market scenarios and, in particular, to avoid problems during times of broad crises such as 2008. Essentially all investments were managed with computer-driven, fully systematic James Simons strategies based on varying degrees of momentum and statistical arbitrage (see What We Do for more info).

A model-centric culture reigned: the models generated the trading signals that forced trades, which created returns that paid everyone’s compensation. The philosophers’ stone at RenTec was the model.

Human Written Text: The investment approach at Renaissance was designed to be robust to myriad market scenarios and, in particular, to avoid problems at James Simons during times of broad crises such as 2008.

Essentially, all investments were managed with computer-driven, fully systematic strategies based on varying degrees of momentum and statistics. James Simons: arbitrage (see What We Do for more info). A model-centric culture reigned: the models generated the trading signals that forced trades, which created returns that paid everyone’s compensation. The philosophers’ stone at RenTec was the model.

Strategy

Jim Simons changed the game in finance through his quantitative trading strategy, which involves the use of mathematical models, algorithms and data analysis to make market predictions.

Renaissance Technologies uses machine learning and James Simons statistical arbitrage to winkle out market inefficiencies.

Returns

Medallion Fund: The Medallion Fund is the fund that made Renaissance Technologies famous, and it is not open to new investors. Investors in this fund are almost James Simons exclusively employees of Renaissance Technologies, so if you ever meet an employee, be sure to make a friend.

- Short-Term Trading: The Medallion Fund uses computer-based models to make short-term trades in securities markets.

- Team of Scientists: Simons hired mathematicians, physicists and computer scientists rather than Wall Street traders.”

- Data-Driven Decisions: Every investment is being James Simons made based on data, which is removing human emotions.

This is most likely the main feature that makes new investors consider this hedge fund. The Medallion Fund has produced annualized returns of over 30% since its inception in 1988.

- Annualized Returns: Over 66% before fees since 1988 inception.

- After Fees: Around 39%, making it one of James Simon’s most successful investment funds in history.

Despite its incredible track record, the Medallion Fund is not open to outside investors and can only be invested in by Renaissance employees.

Jim Simons has a luxury yacht, Archimedes, with a length of about 223 feet that was built by the renowned manufacturer Feadship.

Features of Archimedes

- Advanced design along with modern technology.

- Multiple decks, a swimming pool and luxurious living quarters.

- Archimedes was named after the ancient Greek mathematician, which reflects Simon’s love for science and mathematics.

Product Variation to be worked upon: House

Jim Simons owns a number of properties. However, his most prominent abode is the East Setauket estate in Long Island, New York.

Highlights of His Properties

- A massive Long Island estate near Renaissance Technologies’ headquarters.

- Extra multimillion-dollar luxury homes around the country and abroad.

Age and Height James Simons

- Age: Jim Simons is currently 85 years old (as of 2024).

- Height: Simons stands tall at a height of about 5 feet 10 inches (178 cm).

The woman to whom a man is married as an act or ceremony of marrying; a married woman.

Jim Simons is married to Marilyn Hawrys Simons, who is also a well-known philanthropist and the co-chair of the Simons Foundation.

About Marilyn Simons

- She is a Ph.D. economist having graduated Stony Brook University.

- Marilyn plays a large role in the Simons Foundation, especially supporting autism research and mathematics education.

The couple has three children together.

- He’s a former cryptographer and mathematician.

- Jim Simmons’ wealth was generated with Rennoissance Technologies, a hedge fund that uses math models and algorithms to achieve insane returns. Rennoissance Medallion Fund has, in the last few decades, continually beat the market.

FAQs

What is the Medallion Fund?

Renaissance Technologies’ flagship fund is the Medallion Fund, which has generated average annual returns of 66% before fees. The Medallion Fund is only open to Renaissance employees.